PURSUE Financial Freedom Through Trading

Premium Indicators

Our Premium Indicators are institutional-grade trading tools that help make trading easier, faster, reliable and accurate. Reducing your time spent and cost on charting platforms. Spend less time, earn more!

Premium Indicators

Monthly

$29

- Helps Make Trading More Easy, Fast, Reliable & Accurate

- Important Daily Levels

- Market Internals

- Tick Chart

- Opening Range Breakouts

- Average Daily Range Zones

- Quad Momentum Trend Detection

- Anchored VWAP

- Exponential Moving Averages

- FVG Zones

- VCI Zones

Lifetime

$499

- Helps Make Trading More Easy, Fast, Reliable & Accurate

- Important Daily Levels

- Market Internals

- Tick Chart

- Opening Range Breakouts

- Average Daily Range Zones

- Quad Momentum Trend Detection

- Anchored VWAP

- Exponential Moving Averages

- FVG Zones

- VCI Zones

Three-Legged Goose:

Three Legged Goose is intended to be overlaid on your price chart.

Three-Legged Goose is an all-in-one intraday trading system. This indicator features a sleek and fully customizable opening range breakout overlay with automatic price targets, alerts, and periods, built-in Average Daily Range Zones, pre-programmed anchored VWAPs, total volume, and ATR analysis, as well as our state of the art quad momentum trend detection. Three-Legged Goose additionally has important daily levels, including the previous day’s high and low and the current days open, three fully customizable moving averages, a customizable moving average cloud, and a standard vwap. Using this indicator allows you to get rid of any unnecessary indicators that are taking up those valuable slots in TradingView.

AVWAP + ORBS- This system begins to build off of our recommended 15min opening range and does all of your price target calculations based on the width of the opening range. These targets are fully customizable within the settings, allowing fine-tuning from ticker to ticker. We have pre-programmed three avwaps as a dynamic trend-finding instrument at different time intervals. These, along with the opening range breakout system, can help you quickly spot the day’s trend and dynamic support and resistance long before your standard moving averages have caught up with price intraday.

Average Daily Range Zones- We calculate the difference between the daily highs and lows, averaged over a set period, and then overlay it once the day opens. These zones tend to act as areas of major support and resistance and the projected volatility of the underlying on that day.

Quad Momentum Trend Detection- Quad momentum analyzes four-directional and momentum signals: TICK, ADV/DCN, VOLD, and the underlyings price movement. We paint our analysis directly on your candles. By taking our overall market internals + our underlyings price movement, we can find areas where we can feel comfortable putting more risk on or taking risk-off. This will help those that struggle with identifying trends and valid reversals.

All of the default settings are our recommended settings.

Tick+:

Tick+ is an all-in-one market internals dashboard.

Tick+ features a real-time NYSE or NASDAQ Tick chart, a dynamic Advancers/Decliners vs. VOLD chart, a market internals table readout including both NYSE and NASDAQ instruments, defensive and cyclical sector’s, and daily inflow/out analysis. Also included are customizable symbols readouts, so you can keep an eye on securities that are important to you!

The Tick chart displays a candlestick TICK chart for your chosen exchange and keeps track of the current day’s high tick and low tick. Drawn behind these are our Key Reversal Zones.

The Advancers/Decliners vs. VOLD chart dynamically scales both instruments together to easily detect divergences that are known to cut the noise from the market and give an accurate indication of the day’s trend.

Market Sync Indicator

This is a small but powerful indicator that analyzes the inflow and outflow of each exchange’s underlying securities. When all the markets are in harmony, it will print a green or red symbol below the tick chart. We have also included this signal within the internals table labeled “trending,” which is simply the same signal presented in a more apparent area. Alerts can also be set with these signals to take advantage of the system across tickers.

Note: A gray readout indicates that every market is not moving in the same direction at that moment.

This indicator has been made to be customizable to fit your individual layout style! You are able to stack the Tick & Comparison Charts, as well as display the tables vertically or horizontally!

Note: We are measuring % change of symbols from the daily open to current price, this is so you can make an analysis based on today’s info.

Tick Lite

Tick Lite is our solution to issues caused by indicator processing restrictions.

Our original Tick Plus Indicator was too powerful and had to be split into 2 indicators to guarantee we are giving you the fastest live tick data through it.

You can use Tick Lite with “Tick+” for the entire Tick Plus System, or you can use it on its own if you prefer.

Tick Lite displays the Tick Chart along with our Market Sync Indicator.

The Tick chart displays a candlestick TICK chart for your chosen exchange and keeps track of the current day’s high tick and low tick. Drawn behind these are our Key Reversal Zones.

Market Sync Indicator

This is a small but powerful indicator that analyzes the inflow and outflow of each exchange’s underlying securities. When all the markets are in harmony, it will print a green or red symbol below the tick chart.

Alerts can be set with these signals to take advantage of the system across tickers.

Note: A gray readout indicates that every market is not moving in the same direction at that moment.

We recommend using this indicator with our “Tick Plus” Indicator for the entire Tick Plus System.

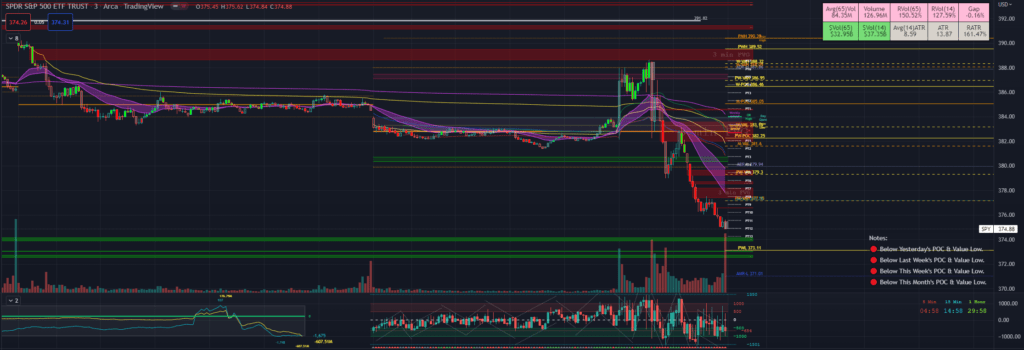

Levels

The Levels indicator automatically draws important market pivots based on multiple timeframe value zones and pivotal trading areas. This information is displayed in front of the price, to keep things out of the way of your price action chart. All of these levels are fully customizable, for visual tranquility, and all values are available to set alerts on. Last but not least is an easy-to-read dialogue box so you know exactly where you are in the auction at a quick glance to save you time while analyzing charts.

Levels included:

Value Low (Day, Week, Month)

Value High (Day, Week, Month)

Point of Control (Day, Week, Month)

VPOCs (Daily)

Highs and Lows (Week, Month)

Average range zones( Day, Week, Month)

Three-Legged Goose Futures

Three-Legged Goose is an all-in-one intraday trading system.

Three-Legged Goose Futures is the same system as our “Three-Legged Goose” indicator, simply optimized for futures trading by working across all futures market sessions.

Three-Legged Goose Futures ONLY works on futures charts, please use our original Three-Legged Goose for equities.

It features a sleek and customizable Opening range overlay with infinitely generating price targets, Average Daily Range Zones, Curated Anchored VWAPs, Total Volume and ATR analysis, as well as our state of the art Market Momentum Trend detection.

Three-Legged Goose also has important Daily levels, including the Previous Day’s High and Low and the Current Days Open, three fully customizable Exponential Moving Averages, a customizable ema cloud, and a toggleable standard vwap .

Three-Legged Goose Futures also includes overnight highs and lows as well as previous New York Session highs and lows.

Using this indicator allows you to get rid of any unnecessary indicators that are taking up those valuable slots in TradingView.

AVWAP + ORBS:

The Opening Range Breakout system builds off of our recommended 15min opening range and does all of your price target calculations based on the width of the opening range. These targets are fully customizable within the settings,

to allow fine-tuning from ticker to ticker. We have programmed three Anchored vwaps at different time intervals to act as a dynamic trend-finding instrument. These, along with the opening range breakout system, can help you quickly spot the day’s trend and dynamic support and resistance long before your standard moving averages have caught up with price intraday.

Average Daily Range Zones:

We believe these zones to be essential to trading, especially with our system. These zones tend to act as areas of major support and resistance as well as give an idea of the projected volatility of the underlying.

Market Momentum Trend Detection:

We paint our momentum analysis directly on your candles. By taking the overall Market Internals + the underlying’s Price movement, we can determine areas where we feel comfortable adding risk on or taking risk off.

This will help those that struggle at identifying trends and valid reversals.

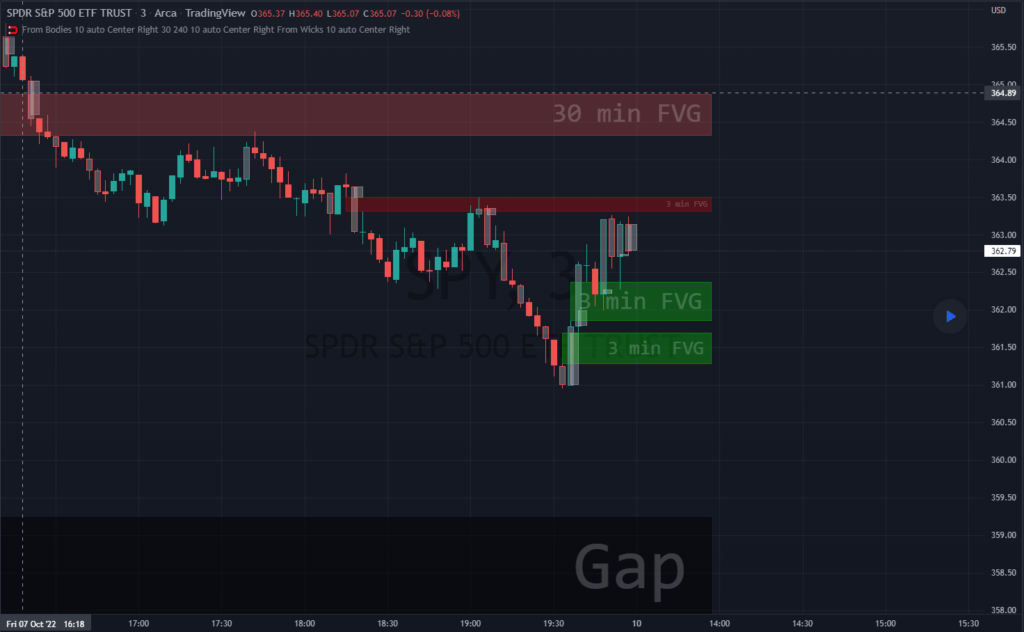

FVG & VCI Zones

FVG & VCI Zones Displays Imbalance Zones formed by specific patterns and progressively delete these zones to keep information relevant.

Fair Value Gap Zones

– Fair Value Gaps are imbalances caused by large buying or selling pressure pushing prices out of an area quickly; because of this orders often get left unfilled resulting in areas of supply and demand.

– FVG Zones can act as support and resistance, drawing price towards them. When a FVG Zone has been filled, the imbalance is considered filled, and the zone is deleted.

– This Indicator Displays up to 3 Different Timeframes of Fair Value Gap Zones.

Volume Candle Imbalance Zones

– Volume Candles Imbalances are uncontested imbalances caused by candles with high volume.

– VCI Zones can be drawn from candle bodies or candle wicks, based on your preference.

Overnight Gaps

– Displays Overnight Session Gaps in Price.

PATI

This indicator is part of our educational suite focused on teaching price structure, momentum, and mean reversion trading strategies for intraday trading. Our team has selected this set of tools and metrics, which define our trading style and serve as the foundation for our teaching, to be included in this indicator. We are displaying each component in a way we believe is helpful to their understanding which also provides a clean, comprehensive look.

This indicator is for Intraday Trading

Our Traders most commonly use this indicator on the 1,3 or 5 minute chart.

Components of this Indicator:

- Multiple VWAP Levels: monthly, weekly, standard (anchored to the right of price)

- Dynamically Anchored VWAP Cloud (trend tool)

- 13 EMA (trend tool)

- Structural Orderblocks

- Multi-Timeframe Fair Value Gap detection

- Key Daily Price Levels (anchored to the right of price)

- Customizable Opening Range (anchored to the right of price)

- 15 minute “Golden Zone” (shows the .5-.618 zone of the previous 15m candle)

- ADR (Average Daily Range)

- A4R (Average 4hr Range)

These tools are used in conjunction with the education we provide to help our users determine their optimal trade plan to utilize their edge.

Specific Functionalities and Uses:

Monthly-VWAP & Weekly-VWAP (M-VWAP/W-VWAP):

VWAP = “Volume Weighted Average Price”

These levels provide probable zones where price may mean revert and risk should be taken off/ put on. We have anchored these to the right-hand side of your chart by default to minimize the noise on your chart.

Average Daily Range (ADR): The Average Daily Range is a technical indicator used to measure the volatility of an asset. It displays how much an instrument can move on average during a given day. The significance is that each market has a unique range that is likely to be covered on any given day.

Average 4hr Range (A4R): The Average 4hr Range is a technical indicator used to measure the volatility of an asset twice in a single session. It displays how much an instrument can move on average during a session and is measured twice in a day. Calculating a smaller volatility range may seem strange at first but can be a huge advantage by analyzing the volatility of the intraday action, giving you average price targets based on more recent market data.

Tip: When used in conjunction with key support and resistance levels, ADR & A4R can be a huge edge to traders to determine where to push/pull risk.

Opening Range: The open often establishes the trend and sentiment for the day, but there is also statistical significance to the open that is overlooked. Statistically, on average, the open is near the high or low of the day and offers plenty of opportunities to build trading strategies. The chart below provides some potential trades that could be taken once the opening range has been established.

Dynamically Anchored VWAP Cloud: Our dynamically anchored VWAP cloud tracks the most recent impulsive move and re-anchors to show you potential bounce points in a trend. We re-anchor at each structural shift to give the most probable targets for buyers/sellers to defend their positions to continue the current trend push.

By utilizing the re-anchoring at each significant structural inflection point, we can establish a much less lagging trend following technique.

We have also included the feature to substitute this cloud for a 34/55 EMA cloud for the traders already familiar with that system.

The chart below provides potential trades that could be taken using the VWAP cloud system.

FVGS (Fair Value Gaps/ Imbalances): These areas represent potential buy/sell side liquidity imbalances where price is pushed aggressively, sweeping the orderbook and will likely return to “fix” the structure before continuing. Below is an example of 3 possible trade paths we look for inside these structural imbalances.

Structural Orderblocks:

These areas are based on structural pivots that have been pushed out of with aggression determined by subsequent structural breaks to confirm their validity. Because of this, when price returns to these areas we can anticipate this area to be defended.

The blue boxes track Orderblocks. These highlight instances of past participation which create areas likely to be defended again when retested.

Swing High/Low/Previous:

We use swing high and lows as points of short-term support and resistance, a break of these levels can signify a shift in market sentiment.

-The dashed green line shows the previous structural swing high or low pivot point.

-The solid green lines show the high and low in our current trading structure.

Note: Displaying the previous swing can provide us with context of the current market trend, and will assist us make better decisions.

15 Minute Golden Zone:

Displayed as a gray box, it tracks the .5-.618 of the previous 15m candle and gives us an area where we look for short-term resistance/support on smaller time frame price action. This area can be viewed as an equilibrium of the current range. If the price can hold this area, it can show a likely support area for continuation.

13 EMA:

This is the choice length ema of our traders, they use this ema to confirm (short-term) trend direction and reference it for a common bounce point for re-entries. Our traders consider this as a crucial point to speculate reversals and break of short-term trends.

Note: Typically in a trend we see the price hold to one side of this ema, by looking for this characteristic, it brings confidence to staying in trades.

STructure Atr Cloud w/ Targets

This indicator is part of our educational suite focused on teaching price structure, momentum, and mean reversion trading strategies. This indicator is recommended to be used with our “Price Action Trading Indicator” or PATI.

Components of this indicator:

- Intraday and Swing Price Structure

- Breaks of Structure Identification

- Change of Character Identification

- Fib-derived Price Targets

- Dynamic ATR-based Trend Cloud

This indicator is intended to be used in conjunction with the education we provide to help our users determine their optimal trade plan to utilize their edge

Intraday (Short-Term) Structure is displayed in gray as HH, HL, LH, LL by default, and the zig-zags can be turned on/off in the settings.

Swing Structure is displayed in yellow as HH, HL, LH, LL by default, and the zig-zags can be turned on/off in the settings.

EQL/EQH show areas where price made an equal low or high.

Dynamic ATR-based Trend Cloud (orange cloud) helps traders stay in profitable trades longer by giving them a visual aid of the current momentum. We have added a confirmation level that dynamically appears when the price breaks over/under the cloud giving validation to the potential trend shift. Failure to break this level tends to result in a rejection and continuation of the current orange cloud trend as you can see in the image above.

Change of Character (ChoCh) shows internal structural breaks where a minor level or supply/demand zone fail, resulting in a potential shift in a short-term trend. Above you can see two common ChoCh setups (head and shoulders/ inverse head and shoulders) that usually result in significant price reversals.

Above is an example of using this indicator on two timeframes to develop short and longer term targets. Previous targets can be used as areas of interest where we can look for price to bounce/reject. Target levels that develop above/below price make great areas to potentially take off some risk/ put risk on.

Short term bullish and bearish signals have been added to signify potential trend exhaustion.

PERIOD VALUE ZONES

Period Value Zones is designed to help traders understand where current value is being found by splitting the day into 3 key periods based on common reversal times recognized for intraday trading.

By splitting the day into 3 periods, we can more efficiently determine where short-term value lies by using only the data we consider relevant during these periods of time.

Overview

This indicator is recommended for low timeframe trading during the New York RTH Session.

By only trading within this session, we can ensure that volume and volatility remain fairly consistent.

Within each Period, you will find on the chart:

-Value Area Points from Previous period (Value High(VAH)/Value Low(VAL)/Point of Control(POC))

-Volume Weighted Average Price (VWAP) Cloud, based on High and Low values during the period.

-Value Zone based Potential Reversal Zones.

Additional Displays:

-Potential Reversal Detection Signals with Invalidation Levels

-Forward Plotted Key Market times.

Components

Value Area Points

VAH/VAL/POC are important volume profile points which display where the market has previously held value.

We use these specific levels as support and resistance to confirm direction by monitoring interactions between price and these important levels.

The VAH and VAL lines change colors based on price’s interaction with them to confirm whether that level should be regarded as support or resistance.

VWAP Cloud

VWAP is a common metric used to determine the strength of a trend, and provides a point to look for re-bid & re-offer.

When price breaks out of our Fixed Value zone, VWAP helps us determine further direction.

Also included is VWAP deviation bands, for traders who would prefer to view the standard deviation away from this cloud as well.

Value Reversal Zones

These Zones are calculated based on extensions of the Period Value Zone.

While in a balanced market, these zones have been shown to provide potential reversal opportunities.

Potential Reversal Signals

These signals are based on an advanced method for confirming a higher-low or lower-high to reasonably create a signal that is not very laggy but also rooted in sound logic.

While helpful, These are NOT buy or sell signals, and you should always use further analysis to decide the next steps to take.

When a signal appears, an associated invalidation level is also displayed, if this level is crossed the associated signal is no longer considered relevant.

Key Market Times

These are important times within the day that normally produce volatility caused by daily market catalysts.

Each key time is forward plotted 1 hour before it occurs to provide a clear heads up for potential opportunity.

– Opening Fuel: Known for having an increase in Volume after the formation of the 15min Opening Range.

– 1st Reversal: Common Area for seeing initial large positioning effecting the market, often causing reversals.

– Initial Balance Close: End of the first hour, a common positioning tool for futures traders.

– 2nd Reversal: Positioning is typically reactionary to IB Close, alongside Euro Traders Exiting Positions.

– Euro Close: Close of Europe Session, a common positioning tool for futures traders.

– Lunch: Usually Low Volume, traders are often out to lunch.

– Lunch End: Volume tends to re-enter, as traders come back from lunch.

– 1st Reversal: New Hour, common area to see large position re-enter the market.

– Bonds Close: Bonds markets close, Equities reacting to close of the bond market.

– 1st MOC: Initial Market on Close orders are places, market reaction is normally expected off of MOC positioning.

– MOC Close: As MOC orders are reported, volatility is likely found within the market.

Methodology

This indicator can be used with the same principles as trading balanced volume profiles.

- Rule 1: Unless the price breaks and holds Value High or Value Low, we should expect buyers and sellers to maintain the current balance.

- Rule 2: If we break and push away from the Period Value High, we should treat that level as supportive on retest unless we look back below and sellers defend on retest.

- Rule 3: If we break and push away from the Period Value Low, we should treat that level as resistance on retest unless we look back above and buyers defend on retest.

- Rule 4: If we recover Value Low, and it becomes supportive, we look for our Period POC and Period Value High as our targets above.

- Rule 5: If we fail to hold Period Value High, and it becomes resistance, we look for our Period POC and Period Value Low as targets below.

Balance in the context of this indicator is considered as the area between Period Value High and Period Value Low

Acceptance outside of balance in the context of this indicator is considered as Period Value Low or High, becoming supportive or resistance.

For examples: https://www.tradingview.com/script/4UIJG8zn-Period-Value-Zones/