The purpose of this strategy is to take a more hands-on approach to owning a stock. You want to own shares in this scenario, but combine selling premium in a safe manner to maximize returns.

The most important part of this strategy is your universe selection, i.e. what stocks do you choose to use with this strategy. Luckily, this newsletter is aimed at finding strong growth stocks that this strategy should work well on.

The biggest risk to this strategy is that you start the wheel up and the stock keeps dropping, so picking when to start is also important. Typically, starting after a stock has had a decent drop is the way to go. Once you have identified your universe, you can proceed to step one

Step One:

You sell a cash-secured put about 30 days to expiration out on a bullish trend reversal or in an area you believe to be the local bottom.

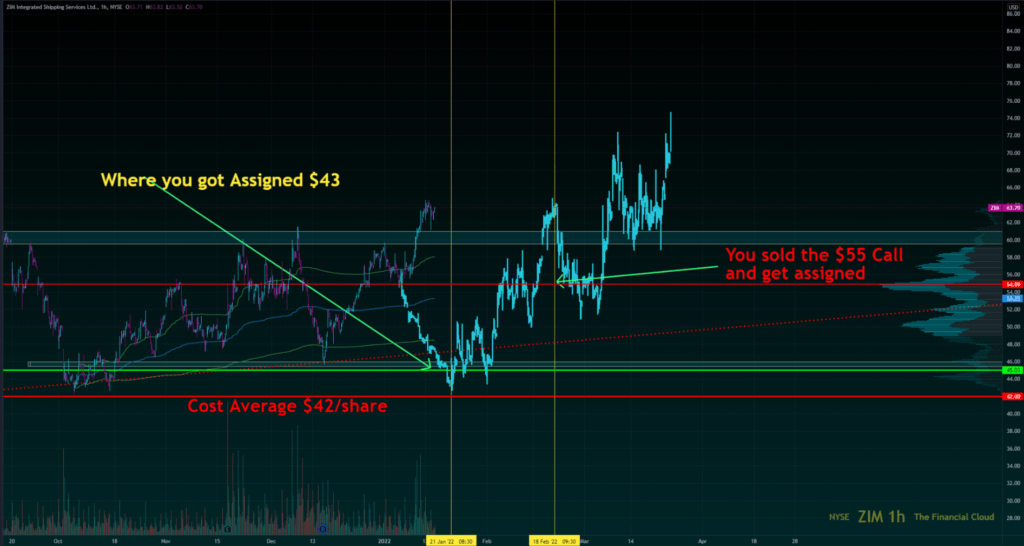

For an example, I will be using one of my top picks for 2022 to showcase $ZIM. In this example, identify a downtrend reversal near previous lows, indicating this stock is most likely to reverse back up. For $ZIM, I believe the local bottom was December 14th of 2021. You can sell $45 puts for 1/21/2022 for $3.00 per share, or $300 per contract since each contract is worth 100 shares. You are doing this because you believe the stock is unlikely to go below $45 in the next 30 days.

This now puts you on the hook for the shares if the stock drops below the $45 strike price you sold the put on. If you end up getting assigned, it does not matter since you want to long the stock anyways (assuming, of course, that you have the cash to purchase the $100 shares).

Scenario 1:

The stock price remains above the strike of the put until expiration. In this scenario the put expires worthless and you keep 100% of the premium you sold. You then look for another entry and sell another put, starting the process over. Proceed to Step 1 and start over.

Scenario 2:

The put expires with a price at $43, below the strike you sold and you get assigned 100 shares. This is not a problem since your cost average is now $42/per share. Note, when you get assigned, you have to buy 100 shares at the strike price (i.e. 45), but your actual cost average would be $42 because you received $3/per share in premium when you sold the contract, so that premium you kept will get deducted from the $45 price at which the contract was assigned. Now you own 100 shares at $42 and can proceed to step 2.

Step 2:

You have been assigned 100 shares at $45/share with a cost average of $42. You now look to sell covered calls at a strike price above your price average and in a price range that you are comfortable with selling the stock. Since you know the stock has rejected the $55-60 area, you look to sell a February 18th $55 call for $1.60/share or $160 total. Deduct that premium from your original cost average, which lowers your cost average to $40.40/share.

Scenario 1:

The call expires out of the money and you continue to sell covered calls and collect dividends. In theory, if you keep selling enough covered calls, you could lower your cost average to zero or even below.

Scenario 2:

In this scenario, the stock closes above the $55 call you sold and you have to sell your shares for $55/share. You collect the premium and a profit of $55 – $40.60 or $14.60/share for a total of $1460 over two months. You then proceed back to Step 1 and look to sell cash-secured puts again.

In Summary:

This strategy will allow you to long a stock with minimal risk and a large upside. The major downside is if you choose a terrible entry and the stock drops way below your strike you sold your cash-secured put on to start. This then starts the cycle of playing catchup but is still way safer than selling unsecured calls/puts, and you have a clear-cut strategy to profit from there. Again two major points I want to highlight, (1) pick fundamentally strong stocks to use with this strategy, and (2) pick a good entry. Doing this will ensure you the strongest returns.