Beat the Market (BTM) has begun. Throughout this series, I will manage a $100,000 paper portfolio account using different strategies such as going long/short, long-term derivatives, covered-call writing, and wheeling. You may know all of these or you may know none of these strategies, but I promise by following along you will start to understand and recognize that you can do the same things.

The main goal of BTM is to see if actively investing money can provide a greater return than a buy-and-hold strategy.

I have been asked these questions numerous times: “Is it possible to beat market returns yourself?” and “Should I try and pick the best stocks for my portfolio?”. Now for most people, I believe ETF investing is the best thing; it’s the safest, easiest, and least time-consuming type of investing possible. Therefore, I encourage most people to buy and hold a few select ETFs (along with a few stock picks) and to continually dollar-cost average (DCA) into those positions.

ETF stands for an ‘exchange-traded fund’. An ETF is like a pre-packaged goodie basket from Walmart– it contains multiple different items that represent the basket’s overall theme. For example, if it were a men’s basket, it could have travel-sized shampoo, shaving cream, razors, and cologne. If you wanted to surprise a a friend with all these items it would be more expensive and tedious to search and purchase all the full-sized items. The easiest thing to do is grab the basket and walk out. This is exactly what an ETF is.

ETFs make investing easier by having a fund manager and his or her team pre-select the stocks that align with the strategy/goal of the ETF. When you invest in the $SPY ETF you are essentially buying fractions of 500 different companies (I.e., Apple, Tesla, Google, Johnson & Johnson, etc.).

Unlike mutual funds, which are strikingly similar, ETFs have two main advantages:

- Lower fees – ETFs are notoriously inexpensive compared to mutual funds. Some have expense ratios (a percentage of how much you pay a year based on the amount held — I.e., $1,000 in holdings with an 0.5% expense ratio equals a $5 fee per year).

- Actively traded – Mutual funds can only be bought at the end of trading hours. Meaning if you want to sell your investments, you have to wait until the trading day is complete. Liquidity of ETFs give them another leg up in the mutual funs vs. ETF debate.

Anyways… back to the point of this.

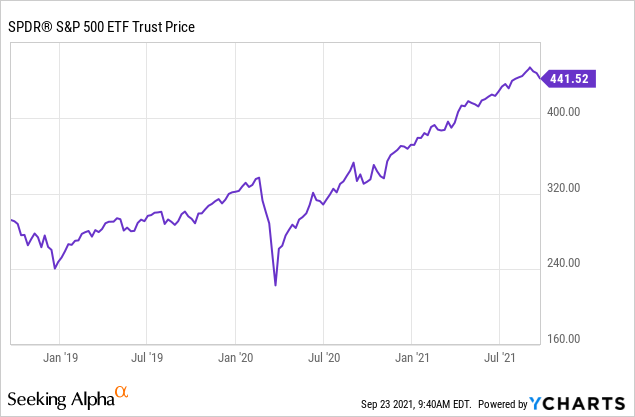

Below is a graph of the S&P 500 Index ETF ($SPY) over the past three years. It’s probably one of, if not, the most notable ETFs in the market. It is considered to be the “market” since it tracks 500 companies and 505 stocks. Looking at the below graph, you can understand why passively investing in indices is the easiest and least time-consuming. All you have to do is buy and hold.

But could there be a better and more exciting way? Potentially. Time and time again we see money managers claim they are beating the market without insider or nonpublic information. Whether that is true or not will probably not be known for a while. What is true is that wealth is built slowly. By managing risk and deploying capital along our guidelines, we will see if we can generate higher risk-adjusted returns than the S&P 500 Index.

$100,000 may seem like a lot to some of you; to some, it may seem like a little. The most important part is not the amount of money you start with, it is the return generated. We will be focused solely on percentages and not dollar amounts as those tell the true story.

Every Friday I will update you guys on:

- what I have bought/sold

- companies on my radar for investment

- current asset allocation

- weekly, monthly, and YTD performance

I will be using E*TRADE’s paper account feature for the Beat the Market (BTM) series. As you can see, we have a fresh account with fake cash that is just waiting to be invested. Let’s jump right in.

– Thomas

Disclaimer: Nothing in this article should be considered investment advice or advice to buy or sell specific securities. The opinions expressed are of the author alone and are for educational purposes. Please consult a financial professional before investing.